[This proposal comes from @meowmeow. Read and discuss the original post here. To support this proposal, sign it using the like (heart) button below this post.]

This is my suggested HOPR liquidity distribution:

![]() Uniswap v2 45% in the HOPR-DAI pair

Uniswap v2 45% in the HOPR-DAI pair

*Uniswap is currently the most powerful and most used dex on the Ethereum network, why not choose it?

Before the end of Hopr Farm, Liquidity on the Ethereum should be maintained at UNI v2.

When the Hopr farm ends, 100% of UNI v2 liquidity will be migrated to UNI v3.

UNI v3 details

Liquidity fee:

0.3%

Price range:

Unlimited

Which moment to choose the price of MA60

The day of liquidity migration

![]() BSC Pancakeswap v2 45% in the HOPR-DAI pair

BSC Pancakeswap v2 45% in the HOPR-DAI pair

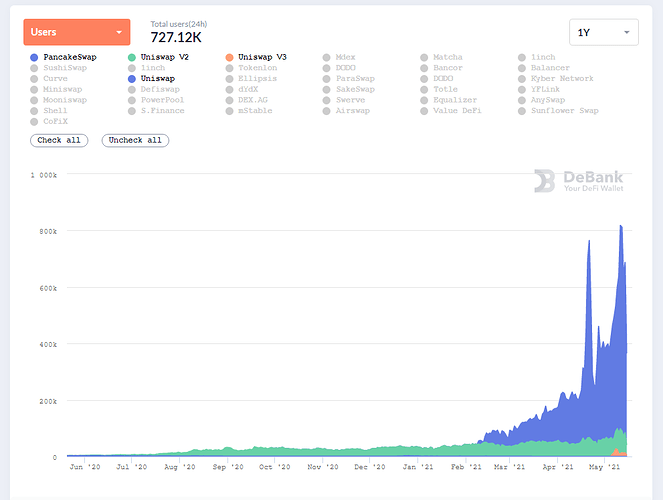

*Regarding bsc, the development of Pancakeswap is advancing by leaps and bounds this year. Compared with the high gas fee of the Ethereum network, BSC gas fee is low, and the single transaction cost is very low. It is very suitable for ordinary user transactions. And the explosive growth of Pancakeswap users, I believe that more users will understand and hold HOPR.

Data Sources: DeBank | DeFi Wallet for Ethereum Users

![]() XDAI Honeyswap 10% in the HOPR-xDAI pair

XDAI Honeyswap 10% in the HOPR-xDAI pair

*Although the Hopr node is running on the xDAI chain, relative to the transaction volume of honeyswap, I think that 10% of the liquidity placed in honeyswap is sufficient.