It was a pleasure! Thanks for having me on.

Looks like a good suggestion

Currently to buy hopr through decentralized exchanges is very complicated, I need to buy usdt with fiat money on centralized exchanges (because buying xdai when transferring is very large because centralized exchanges do not support), then have to transfer usdt to chains like eth, avax, polygol, BSC and then from those chains have to use a bridge to switch to gronis chain, then buy Hopr, so your solution can fix my problems mentioned above?

Yeah that’s unfortunately the situation here. However, I did hear on call that GSR was hired as a CEX marketmaker, so you may be able to purchase HOPR on that centralized exchange directly. This proposal in particular is with regards to DEX liquidity. So it wouldn’t solve the problem you currently have where you have to onboard fiat thru a CEX and then transfer to a network to purchase HOPR. However, I would look into the where HOPR is traded on a CEX if you wish to skip the steps of buying USDT first and then bridging to a chain to purchase HOPR on a DEX.

I use the following two ways to buy hopr on Gnosis Chain.

- Buy xDAI on AscendEX and withdraw them to Gnosis Chain.

- Buy DAI on Binance, with to Ethereum Chain, bright DAI to Gnosis Chain. DAI will be converted to XDAI.

$HOPR is available on Coinbase ![]()

Also, https://ramp.network/ supports xDAI token on Gnosischain.

It can also be cheaper to withdraw from a CEX that supports Polygon, Optimism, or Arbitrum. Then you can easily do any necessary swaps and bridge the funds to Gnosis Chain.

Hi @bp_gamma First of all, thank you so much for all your respectful replies.

Now, there is a discussion for accepting the two proposals first for limited period of time as a sort of trial ![]()

I’m wondering how this sounds for Gamma, and your thought on this idea.

Thank you! I think that’s the right move to split the liquidity between Gamma, Arrakis, and the full-range position. 20/20/60 sounds like the right risk-adjusted ratio as well.

But yeah I appreciate the prudence behind the decision because it is a bigger risk, and with this testing period, it can give us time to digest results.

Also, I do believe I heard on call that Arrakis was still in audit for their v2 contracts, and would be starting a bit later. We would be ready to go, if and when the vote passes. So, it may be even more risk-adjusted in that the DAO is onboarding one provider at a time incrementally.

Those are my high-level thoughts. I saw some more specific questions in that thread, so I can answer there.

If the DAO were to support this proposal, what kind of reporting does Gamma intend to provide, and on what schedule?

We would provide 3 things:

- Transaction addresses for every rebalance event & contract deployment

- Visual diagram of the strategy at work

- Statistics on position composition and instructions on how to read them on chain

We can provide this on a monthly or quarterly basis. With 3) I can provide a google sheet that will allow you to simply plug in the numbers you find onchain that will allow you see the composition at any given time. This includes amount of DAI and HOPR in position as well as the ranges in which liquidity is provided.

Actually this dao take this topic indevualdey , so while i am writing the message i was so impressed

This is fantastic.

Very nice! Would that be public for us to see or is that up to the hopr team?

Absolutely I agree.

The proposal is really interesting, but I am afraid that there will be problems with liquidity.

Good proposal

The contracts and rebalance events would all be public. We can also make a public google sheet that anyone can check the status of.

Would that be a live report or pretty close? Or is that time based report ie weekly/monthly etc.

So the google sheet will give directions on how to read the contract in real time.

Perhaps an example would be easier: FWB Ranges & Position - Google Sheets

That’s the spreadsheet that we sent FWB and its community. If you read the contract in Cell C1, it will take you directly to the position manager contract.

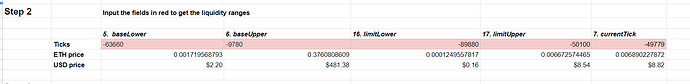

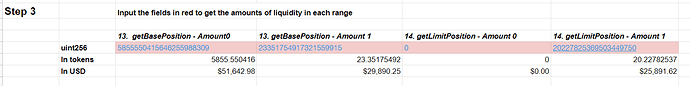

In steps 2 and 3, you’re just copying/pasting whatever is in the contract fields in those red input fields.

Once you update the ETH price in step 4, you should get exactly what the ranges are in USD and the amounts of liquidity in USD of each range.

Example:

So here you’ll see that our base position is managed in a range between $2.2 to $481.38 for FWB and limit position is managed in a range between $0.16 and $8.54

Here you’ll see how much liquidity is in the form of token0 = FWB and token1 = ETH.

So essentially this sheet will allow anyone to read the current state of the contract at any time to get the amounts of liquidity and the ranges that the liquidity is provided in.

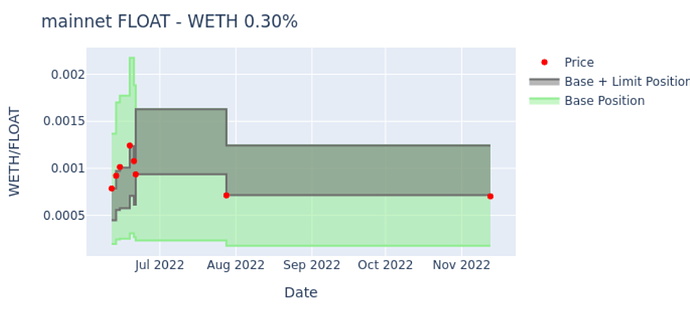

We can also send monthly or quarterly reports on this for those who are not so technically inclined. We also provide visual representations of the ranges such as the below: