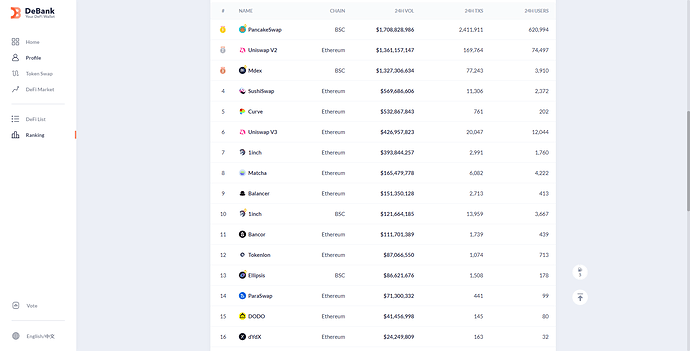

We can allocate the liquidity of each DEX according to the trading volume ranking.

The ranking of DEX trading volume can be queried here.

Ethereum&BSC: https://debank.com/ranking/dex

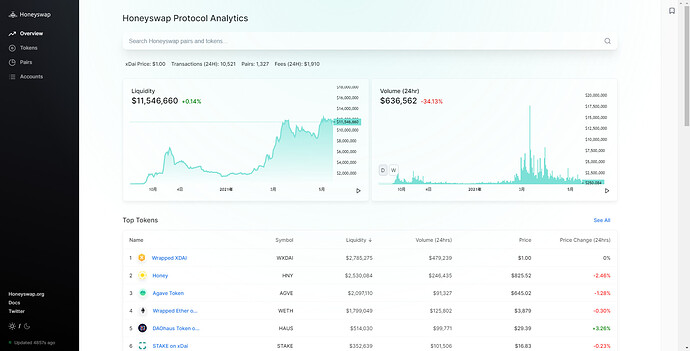

Xdai Chain: https://info.honeyswap.org/home

24H VOL :

UNISWAP(v2&v3)'s transaction volume and PANSWAP’s transaction volume are roughly 1:1.

For XDAI’s Honeyswap, the transaction volume is only about 1 million US dollars per day, which is almost insignificant compared with other dex, but since there are still a large number of xhopr token in xdai chain, I hope to be able to allocate 10% of the liquidity to this.

This is my suggested HOPR liquidity distribution:

![]() Uniswap v2 45% in the HOPR-DAI pair

Uniswap v2 45% in the HOPR-DAI pair

*Uniswap is currently the most powerful and most used dex on the Ethereum network, why not choose it? Regarding the choice of v2 or v3, I think it should be v2. When the Hopr farm ends, we can consider migrating most of the liquidity of v2 to v3.

![]() BSC Pancakeswap v2 45% in the HOPR-DAI pair

BSC Pancakeswap v2 45% in the HOPR-DAI pair

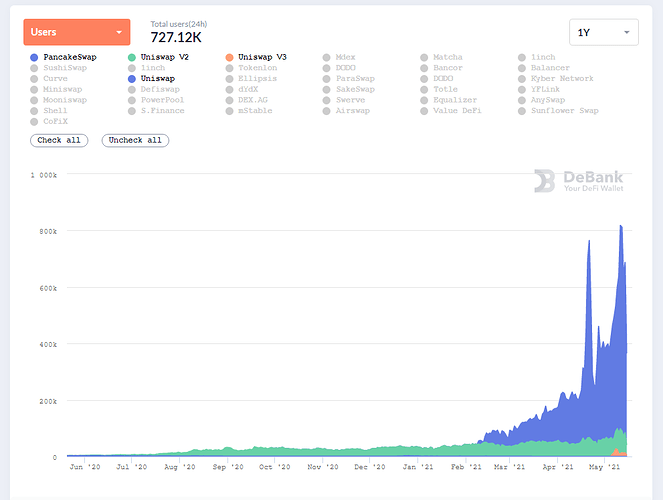

*Regarding bsc, the development of Pancakeswap is advancing by leaps and bounds this year. Compared with the high gas fee of the Ethereum network, BSC gas fee is low, and the single transaction cost is very low. It is very suitable for ordinary user transactions. And the explosive growth of Pancakeswap users, I believe that more users will understand and hold HOPR.

Data Sources: DeBank | The Web3 Messenger & Best Web3 Portfolio Tracker

![]() XDAI Honeyswap 10% in the HOPR-xDAI pair

XDAI Honeyswap 10% in the HOPR-xDAI pair

*Although the Hopr node is running on the xDAI chain, relative to the transaction volume of honeyswap, I think that 10% of the liquidity placed in honeyswap is sufficient.