I think we should all think together how to calculate potential rewards for each proposals.

And then put it clearly in the first post of this thread.

Here is my interpretation below.

Please reply to this thread to comment and improve it. I’ll edit this post with everyone’s input so that we can all have a clear vision when we vote, and avoid vote based on ignorance.

Rewards

It isn’t clear to me how we should calculate rewards and have comparison ground.

I am absolutely not sure if my calculations are correct… Please help.

Even in volatile crypto I’m not sure how much is allocated and would be perceived by the DAO as a reward on top of fees…

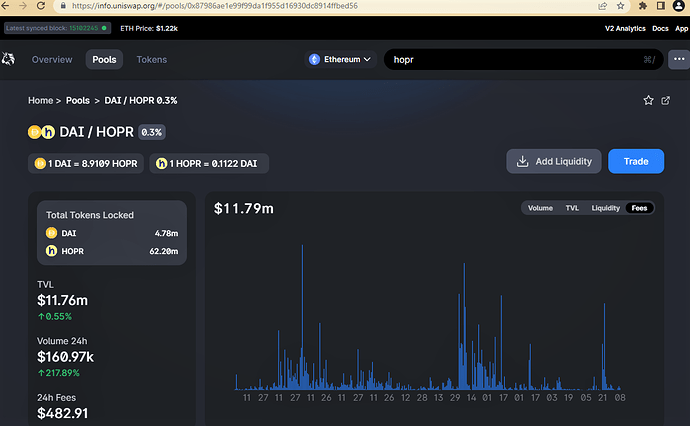

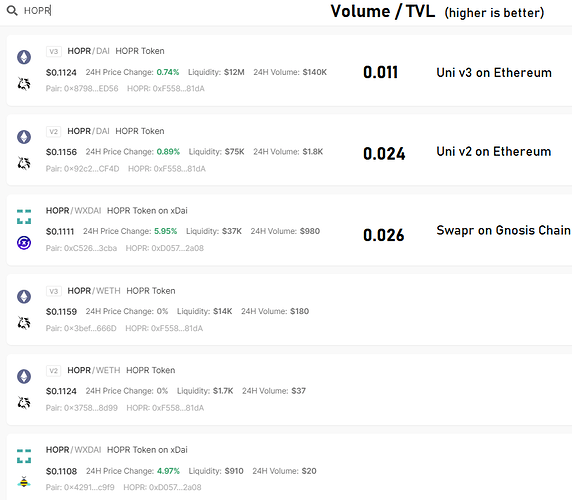

Let’s compare rewards for a $250 000 pool:

- SWAPR ($100 000 pool): ~30,000 $SWPR/Month, hence at $1SWAPR=$0.02, $313.6 * 2.5 = $1568/Month for the $250000 pool, see An update from Swapr

- SUSHISWAP ($250 000 pool): 30*50 = 1500 $SUSHI/Month + ? $GNO rewards, hence at 1 $SUSHI = $1.17, $1755/Month. see DRAFT PROPOSAL 1: HOPR - xDAI pair on Sushiswap (Gnosis Chain)

- UNISWAP: I don’t understand how much.

Not so sure about this calculation at all - it’s pretty much random. But SWPR proposal now seems quite good after they updated it: An update from Swapr